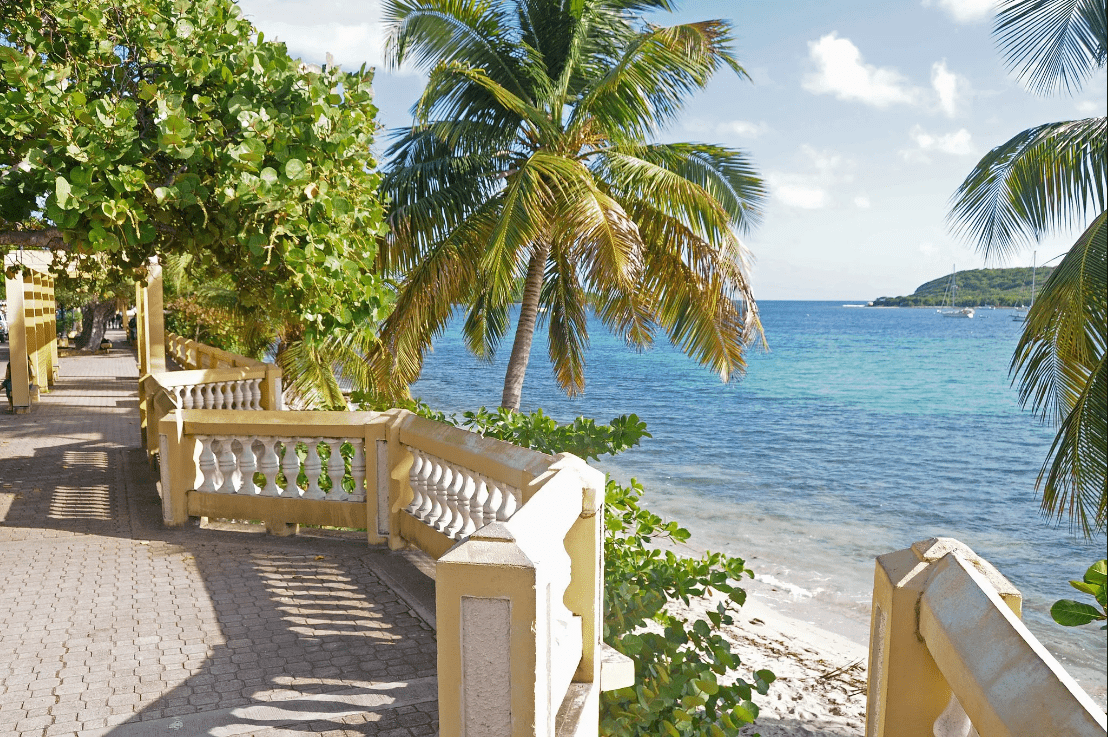

Vieques on your mind. Its natural beauty, its people and their smiles, intense flavors and vibrant colors, the horses roaming around town. And equally present the often unspoken reality of island living marked by a different rhythm and pace, unique challenges, but also unique rewards. Yes, we hear you. You have been thinking of making the move and relocating to Vieques! Or perhaps you are considering investing on a vacation or rental property. But after contemplating the thought of endless summer and picture perfect life prints, you may be asking yourself: “Is buying a feasible option for me? Is the process any different than in other countries? How do I start looking for a property?” Unfortunately, there is not one right answer or even a standardized model for real estate transactions in Puerto Rico. On the contrary, there are many considerations that make each deal unique. Further, there is not a lot of official, current or verifiable information on the subject, and in the case of Vieques, this piece of tropical paradise comes with additional real estate challenges. But despite the potential challenges, as long as you are clear about your goals and motivations, the experience of buying a home in Vieques or somewhere else in Puerto Rico will certainly be worth the extra due diligence and time. If you are new to the realities of Puerto Rico and Vieques real estate and before you make a decision, here are a few basic things every buyer should know:

CAN FOREIGNERS AND NON-RESIDENTS BUY REAL ESTATE?

Companies, as well as other nationals may purchase property in Puerto Rico without any time cap or restriction. That includes perpetual fee simple ownership conveyed through a Deed of Sale.

FINANCING

Mortgage lending in Puerto Rico falls under the domain of the United States Department of Housing and Urban Development (HUD) and is also covered by Truth-In-Lending-Act and Real Estate Settlement Procedures Act (TILA-RESPA). Therefore, although the process can vary from one scenario to the next, most people find that buying a home in Puerto Rico is very similar to buying in the continental US, Alaska, and Hawaii. On the other hand (and just like everywhere else), cash buyers must remember that the flexibility and ease of a cash transaction should never minimize the need for careful and detailed due diligence. Always request a property title search, copies of available and approved surveys, copies of all property deeds and a list of private or third-party liens.

WORKING WITGH AN AGENT

Although broker’s fees are unregulated in Puerto Rico, typically we see commissions between 5-6% paid by the seller. A buyer has the right to represent him or herself during a real estate negotiation or retain the services of a licensed agent. Nonetheless, it is common to see brokers acting as dual agents. If this is the case, remember to ask for a “dual agency” clause in your agreement. When choosing a real estate professional remember that a knowledgable agent can not only help you sort through all types of available listings, but will help you understand and navigate through the intricacies of the local market, the required paperwork and procedural landscape.

HOME PRICE AND COMPARABLE DATA

Puerto Rico has an MLS, however is not as widely used as in the continental U.S. The lack of participation in this local listing service means that comparable sales data is often not available. Nonetheless, real estate professionals can ofter run comparable sales reports from other sources and third-party data services.

PURCHASE AGREEMENTS

Purchase agreements as well as any other other real estate matter in Puerto Rico are based on Spanish Civil Law and although it presents a different process from what some buyers may be accustomed to, it can deliver the same result of a issuing recordable, marketable and clear title. Fee simple ownership is conveyed through a Deed of Sale executed by an attorney. Escrow money is typically deposited with the listing broker into a trust or escrow account rather than using an escrow company. All purchase agreements are binding and although not required, it is in the buyer’s best interest to consult with an attorney before fully executing any legal documents or transferring any option monies.

SELLER DISCLOSURE AND INSPECTIONS

Despite the fact that Puerto Rico does not have a Sellers Disclosure Form, that should not deter buyers from asking for disclosures. In fact, while sellers are required to disclose any material defect, buyers have the right not only to ask for disclosures pertaining the condition of the real estate, but to request detailed information regarding title reports, appraisals, rent records, easements and liens and any other matter that is of concern. It is highly advisable that you hire a home inspector and make your agreement contingent on it. Know that most home sales in Puerto Rico are “as-is” and owner repairs are rare, therefore it is important you factor in the cost of those improvements before you make an offer. When doing a home inspection, remember that construction practices in Puerto Rico are not the same as in the U.S. In fact, the Puerto Rico Home Contractors Association (ACH) estimate that 55% of existing structures in Puerto Rico are considered “informal” construction or simply not up to code. Pay attention to things such as electric, plumbing and windows as they may follow practices unfamiliar to you. Often times, the listed structure size (in square feet) is an estimation while land size is listed in square meters. Pay attention to things such as electric, plumbing and windows as they may follow practices unfamiliar to you. And when in doubt, do not take the first available opinion as fact, but rather take the time and if necessary pay to consult a professional. The blog site Expat.com posted a few years ago (though still relevant) an interesting perspective from a buyer from Florida on this topic. You can read about it here.

TITLED VS UN-REGISTERED

In Puerto Rico ownership of real property is recorded at the Registry of the Property. This process grants “title-ownership”. A property that has not been recorded at the Registry of Property is usually referred to as “Unrecorded-Titled”, a very common practice in Puerto Rico going back decades where owned land was passed down from generation to generation lacking the proper paperwork to get the property registered. In Vieques we have to account for the fact that the U.S. Navy expropriated thousands of acres of land during the 1940’s forcing people to move into Nany-designated resettlements, to relocate to the main island of Puerto Rico or to neighboring St. Croix. The details and historical facts around Vieques’ land expropriation continue to be an incredibly complex subject, and today we see how that can account as one of the many reasons why purchases of property are more complex in Vieques than in many other municipalities of Puerto Rico. Adrienn Lanczos of Colibri Realty in Vieques estimates that 50% of Vieques properties have not been recorded at the Registry or have a cloudy title.As a prospective buyer you must be aware that either titled or un-registered properties are viable purchase options but when opting for an “untitled” property you are only acquiring possession rights. It is a decision that must be carefully considered with an understanding that getting onecan be a challenging and lengthy legal process, sometimes taking years to reach a final resolution, not to mention the potential cost estimated in the thousands of dollars. A land survey and a title search conducted by an independent professionals are some of the most valuable reference tools you can have to help you structure and plan for your purchase.

TITLE INSURANCE

Title insurance is available in Puerto Rico and is meant to protect an owner or lender against loss due to title defects, liens or other matters. Policies and rates are regulated by the Office of the Insurance Commissioner. Additionally, Registrars of the Property may also issue certifications of register inscriptions. It is important for buyers to verify and understand wheather the issued closing statement includes a Buyer Policy or not.

PROPERTY TAXES

Property taxes, regulated and collected by CRIM (Centro Recaudación de Ingresos Municipales) are prorated and usually paid twice per year. When buying property in Puerto Rico, a buyer is responsible for unpaid property taxes for the current and last five years. Therefore it is imperative you order a real property tax debt certificate, a recent account statement and a certification of assed value before closing. A tax assessment, along with other transactions such as payments, certifications and notifications of changes in ownership can now be done online through their platform www.crimpr.net. Avoid costly oversights and order your tax assessment immediately after your offer has been accepted!

INHERITANCE LAWS AND COURT JURISDICTION

Often overlooked by buyers is the fact that all real estate located in Puerto Rico is subject to Puerto Rico’s inheritance law. This includes forced heirship laws dating back to Spanish rule designed to keep the property in the family. Children, grandchildren or direct blood descendants like parents become forced heirs regardless of any wills or legal actions taken outside of Puerto Rico. In fact, the Puerto Rico Inheritance Law dictates that one-third of the inheritance is equally split between the forced heirs. When real property is part of the inheritance it is always executed in the Puerto Rican court system. Whether you are planing to live in Puerto Rico full time or are just considering investing in income property, make sure you consult with an attorney to discuss how you can protect your investment in the future.

INVESTING OPPORTUNITIES

Puerto Rico is widely considered an emergent and diverse market for investing opportunities. And while not included on the list of coordinated territories where 1031 Exchanges are allowed, the island offers several other tax deferment tools and incentives popular among investors. Ranked at the top of the list of The New York Times“Best Places to Go 2019”, the entire island has now been been designated as a Qualified Opportunity Zone. A qualified financial consultant can help you determine if these incentives and initiatives are right for you.

CLOSING

Closing dates are scheduled according to the complexity of each sale, whereas a sixty day closing is common assuming there are no delays in the process. Public deeds must be prepared by a Notary chosen by the buyer. A Notary Attorney is licensed to register property deeds and is required by law to advise all parties equally. In most cases, all parties involved partake in closing, including notaries, lender, realtors, and of course, seller and buyer. Be prepared for a long day as closing can take hours! Remember, things may be a little less structured than what you expect so don’t be surprised if the proceedings take a somewhat relaxed approach. Finally, remember to add a walk-thorough of your new home as a contingency in your purchase agreement and have it scheduled prior to closing.

Although closing costs can be negotiated, a common breakdown will have the seller paying for broker’s commission and split notary cost. The following table as published by Global Property Guide, illustrates a typical breakdown of what you can expect for closing related costs. Plan ahead by including that additional expense as part of your budget needs.